National Stock Exchange (NSE)

Price: ₹2,392

About NSE India Limited Unlisted Shares

(i) National Stock Exchange Ltd. of India (NSE) is India's leading stock exchange and the second largest in the world in terms of number of shares traded during January-June 2018, according to a World Federation of Exchanges (WFE) report.

(ii) NSE introduced electronic screen trading in 1994 and derivatives trading (in the form of index futures) and internet trading in 2000, both firsts in India.

(iii) NSE has a fully integrated business model that encompasses listings, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education services. NSE also monitors compliance with the exchange's rules and regulations by trading and clearing members and listed companies.

(iv) NSE is a pioneer in technology and ensures system reliability and performance through a culture of innovation and investment in technology. The range and breadth of its products and services has enabled NSE to achieve a sustainable leadership position across multiple asset classes in India and globally, responding quickly to market demands and changes, innovating in both trading and non-trading businesses, engaging with market participants and providing quality data and services to its customers.

(v) NSE was incorporated in 1992. It was licensed as a stock exchange by SEBI in April 1993 and began operations in 1994 with the introduction of the wholesale debt market and the cash market segment soon thereafter.

History of NSE

1995: Incorporated wholly owned subsidiary NSE Clearing, India's first clearing company as per the Oliver Wyman Report. NSE Clearing was launched in the Year it started clearing and settlement operations.

1998: Incorporated subsidiary NSE Indices as a joint venture with CRISIL Limited to run the index business. NSE Indices became a wholly owned subsidiary in 2013 after acquiring a 49% stake from CRISIL.

1999: Incorporated NSEIT, a wholly owned subsidiary, is a global technology company offering end-to-end technology solutions, including application services, infrastructure services, analytics as a service, and IT-enabled services. NSEIT opened a Testing Center of Excellence and an Integrated Security Response Center in 2015 and 2016, respectively.

2000: A wholly owned subsidiary, DotEx, was established, and the data and information sales business was integrated into DotEx.

2006: A wholly owned IT research and development company, NSE Infotech Ltd., was established.

2016: Education business was integrated into a wholly owned subsidiary, NSE Academy. To further NSE's long-term business strategy of establishing an international stock exchange in GIFT City, two new subsidiaries, NSE IFSC Limited and NSE IFSC Clearing Corporation Limited, were established.

Subsidiaries of NSE

Price Trend of NSE Unlisted Shares

NSE is one of the best-performing stocks in the unlisted market and always makes a good investment decision for investors. Unlisted shares have consistently fallen by up to 50% in the past year. Despite the significant fall in most of the unlisted shares, NSE has risen from Rs 3400 to Rs 3700 per share. The price of NSE Unlisted Shares in August 2022 was Rs 3400, and now it is Rs 3700.

Current Valuation of NSE Unlisted Shares in the Market

The price of NSE Unlisted Shares in the unlisted market is Rs 3700 per share, and the total issued shares are around Rs 500 crore as of March 31, 2023. Thus, the valuation of NSE in the unlisted market stands at Rs 1,850,000 crore. The valuation has tripled in the last three years. Similar growth is also reflected in NSE's revenue and PAT over the last three years, making it still an undervalued stock. As per the trends in options trading volumes on the stock exchange, this valuation will continue to rise in the future.

IPO News

NSE IPO is expected to take place within the next two years. In the past, market regulator SEBI had issued orders against NSE for violating securities contract rules, and some authorities had also launched an investigation into the co-location case, delaying the IPO. However, the co-location case has already been resolved by the SAT, and the SC had directed SEBI to refund Rs 1,000 crore collected in the co-location case. However, SEBI has appealed, and the hearing is scheduled for September 23.

Fundamentals

Income Statement

Balance Sheet

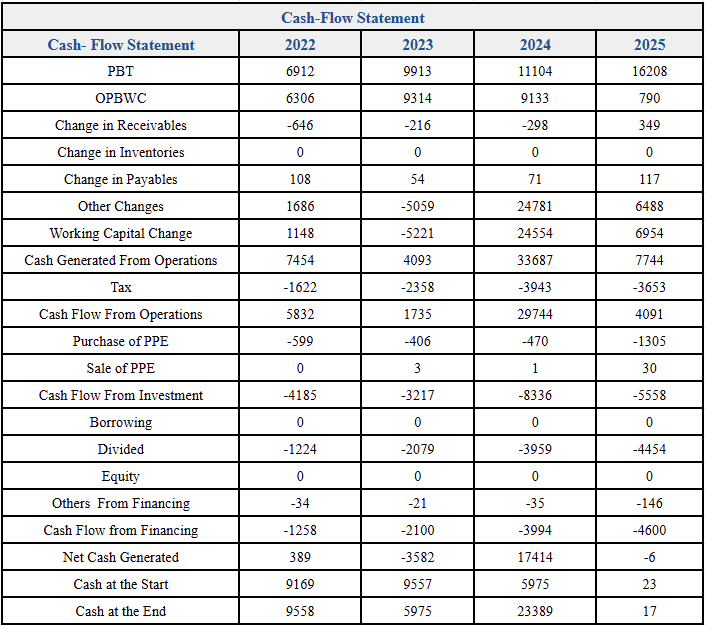

Cash Flow

Why NSE Unlisted Share is a Smart Pick for Future Growth

Investing in NSE (National Stock Exchange) unlisted shares presents a unique and strategic opportunity for forward-looking investors. As India’s largest and most dominant stock exchange, NSE has established itself as a critical pillar of the country’s financial markets. It handles the highest volumes in equity and derivatives trading, with over 90% market share in the derivatives segment alone. What makes NSE particularly attractive is its consistent financial performance—posting annual profits of over ₹7,000 crore—and its focus on technological innovation, efficient infrastructure, and regulatory compliance. The exchange is well-poised to benefit from India’s growing economy, rising retail participation in equity markets, and increasing demand for transparent, digital-first trading platforms. With a SEBI-approved IPO in the pipeline, early investors in NSE unlisted shares could benefit significantly from value appreciation upon public listing.

However, accessing unlisted shares can be complex and risky without proper guidance. That’s where SN Capital comes in. As a trusted unlisted shares dealer and pre-IPO investment advisor, SN Capital bridges the gap between private equity opportunities and retail or HNI investors. The firm offers verified access to NSE unlisted shares, ensuring transparency and security throughout the transaction. SN Capital also conducts deep due diligence, provides clear documentation, and supports investors with market insights and exit strategies aligned with the company’s IPO plans. Whether you're looking to diversify your portfolio or gain early exposure to high-quality companies like NSE, SN Capital offers the expertise and support to help you invest with confidence. With end-to-end service and a commitment to trust and performance, SN Capital is the ideal partner for unlocking long-term value in NSE unlisted shares before they go public.

%20Limited%20logo.png)

logo.png)

logo.png)