OYO Ltd

Price: ₹50

About ORAVEL STAYS LIMITED (Oyo Unlisted Shares): Brief about Oyo

(i) According to RedSeer, Oyo is a leading provider of modern technology platforms powering a large but highly fragmented global hospitality ecosystem. Since its inception in 2012, the company has been focused on reimagining short-term accommodation and has developed a unique two-sided technology platform focused on comprehensively solving the key pain points of its customers (owners, landlords, and/or public company executives) where the platform is the supply side and the customers (travelers and guests who book accommodations at the customers' outlets through the platform) are the demand side. The unique business model helps customers transform fragmented, unbranded, and underutilized hotel properties into digitally enabled branded outlets with higher revenue potential, providing customers access to a wide range of high-quality outlets at attractive prices.

(ii) As of March 31, 2021, there are 157,344 merchants listed on the platform in over 35 countries. Customers use the platform to manage all mission-critical aspects of their business operations. Our comprehensive, full-stack technology suite integrates over 40 products and services for digital onboarding and onboarding—sales Management. Day-to-day business management and 02C are integrated into two key Patron applications - Co-0Y0 and OYO OS. This gives customers a significant digital presence across an extensive distribution network. Customers can book stores through their own D2C channels on the platform and through indirect channels with third-party OTAs. The OYO mobile application provides various digital tools to accompany the entire customer journey, including discovery. Seamless booking. Pre-stay and cancellation assistance. Digital check-in and services are available during and after your stay.

Business Model of OYO

OYO's business model is based on customers listing their stores on its platform and a large customer base booking accommodation at their stores through the OYO platform. OYO's hotel and residential customers' value proposition is based on an integrated, full-stack technology suite that supports all mission-critical aspects of their business. In return, customers are granted distribution rights (primarily on an exclusive basis) and significant control over pricing decisions related to their store inventory, maximizing sales potential through dynamic pricing algorithms. They distribute their patrons' hotel and residential real estate storefronts through D2C channels on the platform and indirect channels with third-party OTAs, generally generating an average revenue share of 20%-35% of GBV (excluding discounts and loyalty points), creating a strong alignment between 010 and its users. They also offer a listing-only service where patrons can list their stores on the platform by paying a fixed subscription fee.

Asset-light Model of OYO

The company has an asset-light business model and a lean cost structure. They do not own the stores listed on the platform. As of March 31, 2021, 99.9% of the stores do not have investment agreements with the company that involve minimum guarantees or fixed payment obligations. Capital expenditures: Covers the majority of staff and other costs associated with running a store. Services: Customers can list their stores on the platform for a fixed subscription fee.

Hotels Listed on CYO

As of March 31, 2021, 157,344 stores across over 35 countries are listed on the platform. As of September 9, 2021, the company has the largest hotel retail presence in India and Southeast Asia and the second-largest retail footprint in Europe among full-stack short-term accommodation providers. According to RedSeer, they made a conscious strategic decision to focus on these regions as their core growth markets. As of March 31, 2021, these markets account for over 90% of their total stores globally.

Key takeaways from OYO 2021-22 Annual Reports

1. Revenue from operations increased from -3,900 Cr in FY21 to -4,700 Cr in FY22.

2. Adjusted EBITDA loss reduced from -1700 Cr in FY21 to -470 Cr in FY22.

3. Gross bookings increased from -6,600 Cr in FY21 to -8,100 Cr in FY22.

4. OYO is now shifting focus from rapid growth to sustainable growth to increase OYO's profitability.

5. Currently, OYO is focused on India, Southeast Asia, and European markets.

6. The IPO is expected next year.

Key takeaways from CYO 2022-23 Annual Reports

1. OYO reported a 14% increase in total revenues for FY23 from Rs 24,905 crore to Rs 25,602 crore.

2. The company has been able to significantly reduce its net losses by 34%.

3. Adjusted EBITDA loss also registered a notable decline of 68% - ZZ 374 million from ZZ 1.16 billion last year.

4. The company has opened 10 Palette Resorts in cities like Jaipur, Hyderabad, and Mumbai. It plans to add 40 Palette Resorts to its portfolio by the second quarter of fiscal 2024.

5. The IPO is expected to take place this year.

Fundamentals

Income Statement

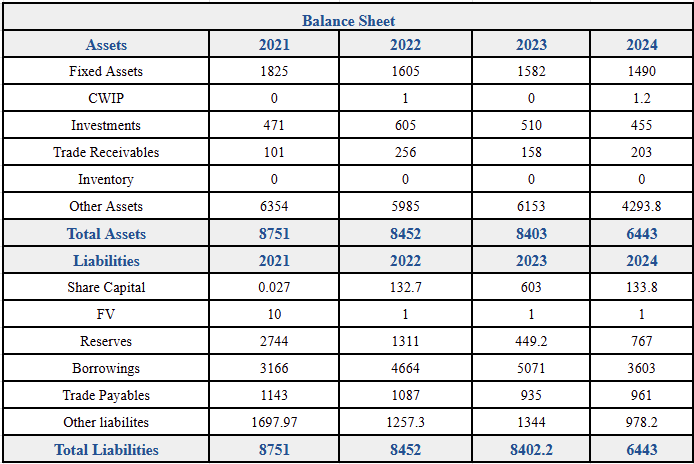

Balance Sheet

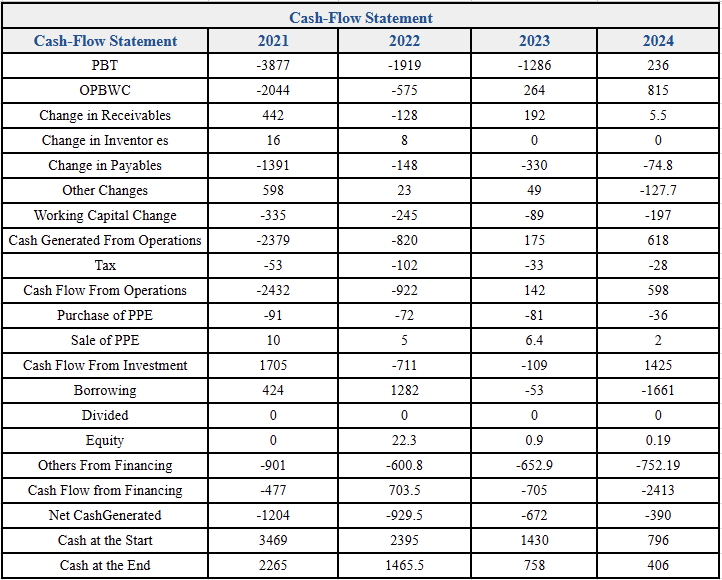

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)