Care Health (Previously Religare Health) Insurance CompanyLimited

Price: ₹164

About Care Health (formerly Religare Health) Insurance Company Limited - Unlisted Equity

(i) Care Health (formerly Religare Health) Insurance, the health insurance division of Religare Enterprises Limited (REL), is a boutique health insurance company that provides health insurance benefits to corporate employees and individual customers, and also provides financial inclusion. RHI commenced operations in 2012 and currently has three major shareholders: Religare Enterprises Limited, Union Bank of India, and Corporation Bank.

(ii) Care Health (formerly Religare Health) Insurance currently offers health, critical illness, and personal accident insurance products in the retail sector—additional insurances: international travel insurance, maternity insurance, corporate group health insurance, and group accident insurance.

(iii) Care Health Insurance (CARE) strengthened its position as a major player in the Indian health insurance sector. As of FY23, CARE is the second largest Standalone Health Insurance Company (SAHI) in the Indian health insurance market and eighth overall. Notably, in the private health insurance segment, CARE ranks 4th among all insurers and 2nd among SAHI.

(iv) From FY2018 to FY2023, CARE significantly expanded its market share in various health insurance segments. Notably, its share in total health insurance increased from 2.5% to 5.3%, and in the private health insurance segment risen from 4% to 7.7%. In the group health insurance, it was from 1.7% to 4.3%. This growth is reflected in impressive compound annual growth rates (CAGRs) of premiums for the total, retail, and group health insurance segments of 36%, 35%, and 45%. or.

(v) CARE’s premium distribution channels have a diverse mix: 35% from individual representatives, 18% from company representatives, and 13% direct (also online). Over the last five years, the contributions of individuals and corporate representatives have increased. The company has a strong network infrastructure with 248 branches and 251,000 agents. Partnered with 149 corporate representatives and over 22,900 hospitals.

Health Insurance Segment:

(i) Only 4% of the population has individual or family insurance. Including group health plans and government plans increases the coverage rate to 38%.

(ii) High penetration in states such as Maharashtra, Gujarat, and Delhi. However, overall penetration remains low even in these states.

(iii) Potential to increase coverage by 2-4 times. The Compound annual growth rate (CAGR) of ticket size for existing customers is expected to be 10%. Ticket size for new customers is expected to be reduced by 20%. Projected industry growth: 4.5x to 7.6x. To reach Rs 1.6-2.6 trillion.

(iv) Market share growth:

a) FY23. SAHI held 28.1% market share of overall health insurance, up from 27.3% in FY22.

b) In the private health insurance segment, its market share increased from 51% in FY22 to 54% in FY23. This is a notable increase from 19% (universal health insurance) and 37% (private health insurance) in FY19.

(v) Growth Drivers:

a) The major factor contributing to this growth is the effective use of individual agents in distributing insurance policies.

b) By the end of FY23, SAHI had a total of 1,158,676 representatives, whereas the 24 integrated multi-insurers (both public and private) had 676,774 representatives.

(vi) Product Range and Distribution Network:

a) SAHIB offers a comparatively wider range of health insurance products than the private multi-insurers.

b) Insurance brokers and company representatives are now allowed to enter into collaborations with SAHI to expand their distribution network. Agents tend to sell health insurance products from SAHI while selling other general insurance products from multiple insurance companies.

(vii) Future Outlook:

Given these advantages, SAHIB is expected to continue dominating the retail health insurance market for the long term.

Business Development for FY 20-21

1. For the financial year ended March 2021, Care Health's Gross Domestic Premium Income (GDPI) increased to Rs 2,559 crore (excluding Ayushman Bharat) from Rs 1,975 crore, registering a growth of 29.5% over FY19-20.

2. Profit after Tax (PAT) for the year increased to Rs 102 crore. It grew by 55.7%.

3. The solvency ratio was 2.45, one of the highest in the industry and well above the statutory minimum requirement of 1.50. This indicates that the company is well-capitalized.

4. The company has launched some new products, namely Care Advantage and Arogya Sanjeevani. Coronavirus Response. COVID Care. Group Support 360. Care Shield Addon. Explore V2.

5. Four new branches were opened last yea,r taking the total number of branches to 158. The company employs around 9,904 permanent employees. The number of agents, who form the core of all insurance companies, has increased from 1,32,474 to 1,69,183 as compared to the previous financial year.

6. Care Health Insurance has partnered with over 16,000 healthcare network providers to provide cashless services to its customers.

Funding in FY20-21

1. Care Health has allotted 79,867,980 equity shares of Rs 10 per share to M/s Trishikhar Ventures LLP and other shareholders at a premium of Rs 27.89 per share to raise Rs 337 crore.

2. Care Health also issued ESOPs worth Rs 3,320 crore.

Current Unlisted Care Health Share Price:

Currently, Unlisted Care Health's share price is 3175 with earnings per share of 32.61.

Unlisted Care Health Stock Results Analysis for FY23

1. Total Direct Premiums FY23 recorded a significant increase in total direct premiums. It reached Rs 31,495.46 Cr in FY23 compared to Rs 31,250.77 Cr in FY23. This growth trend is also reflected in the annual figures, with total direct premiums written reaching Rs 35,141.52 Cr in FY23, up significantly from Rs 33,880.91 Cr in FY22. This indicates that premium income generation for long-term care insurance is on a healthy growth curve.

2. Net Premium Earned Net premiums earned also showed a positive trend in FY23 ending April, reaching Rs 31,201.59 Cr. as against Rs 3969.61 Cr in FY23 ending March. Similarly, net premiums written increased to Rs 33,932.04 Cr. in FY23 as against Rs 510.84 Cr in FY22.

3. Operating Profit Operating profit increased significantly in Q4FY23, standing at Rs 3,519.27 Cr. as compared to Rs 347.20 Cr. in Q3FY23. Annual operating profit also increased significantly, reaching Rs 3,643.72 Cr. in FY23 against Rs 3,282.97 Cr. reported in FY22.

4. Net Profit Net profit stood at Rs 399.27 Cr. in Q4FY23, representing an increase of Rs 356.84 Cr. in Q3FY23. Annual net profit for FY23 stood at Rs 3,245.84 Cr, a significant improvement from Rs 311.50 Cr in FY22.

5. Total Net Assets Nursing Care Health Insurance's total net assets increased to Rs 31,349.17 Cr in FY23 from Rs 31,289.20 Cr in FY22.

6. Earnings Per Share (EPS) Annual EPS for FY23 stood at 32.61. This reflects significant growth compared to 3,013 in FY22. This suggests higher earnings available to shareholders per issued share, highlighting the company's profitability and return on capital potential.

Valuation Care Health Vs Star Health

Comparing Care Health to Star Health Care, Care Health has a market capitalization of around Rs 14,000 crore and shares outstanding of around Rs 150 crore. Gross Written Premiums (GWP) remain at Rs 5,141 crore, implying a Mcap/GWP ratio of 2.74x. On the other hand, Star Health's market capitalization is around Rs 34,308 crore, its share price is Rs 590, and its shares outstanding are around 5.82 crore. Its GWP is around 11,000 crore, giving a Mcap/GWP ratio of 3.11 times. In comparison, Care Health is relatively cheaper than Star Health due to its lower Mcap/GWP ratio. This indicates a more favorable market capitalization of total premiums.

8. Conclusion Overall, Care Health has demonstrated stellar financial performance in the fourth quarter and throughout the fiscal year 2023. The company has seen significant increases in premium income, net income, operating income, and earnings per share. In addition, the significant increase in total net assets indicates a strengthening of the financial position. These positive indicators indicate an effective business strategy, solid operating performance, and an improved presence in the nursing care medical insurance market.

Results of 9MFY24

Fundamentals

Income Statement

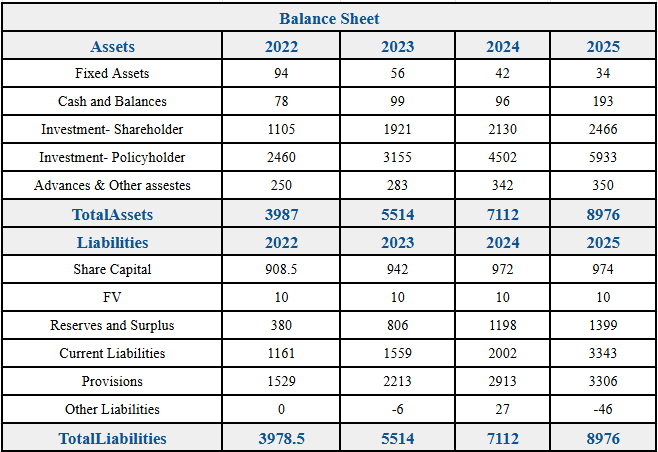

Balance Sheet

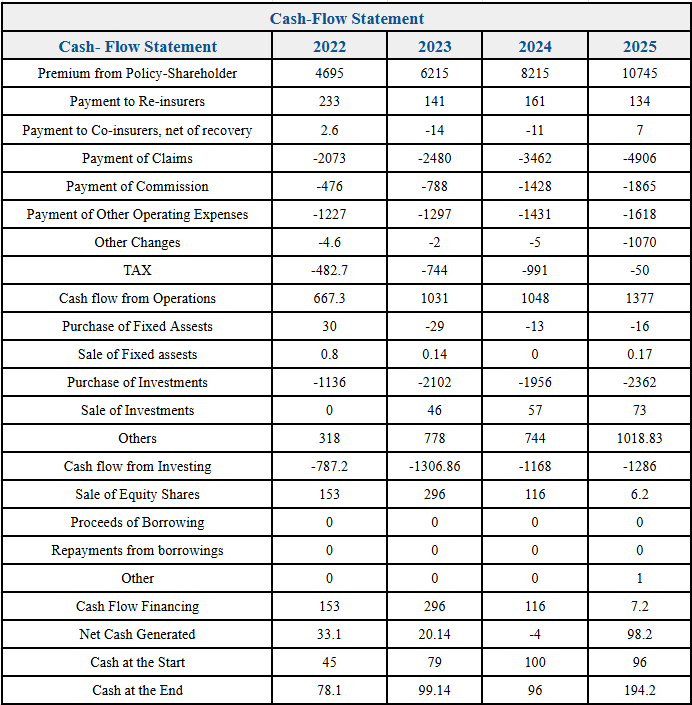

Cash Flow

Why Care Health Unlisted Shares is a Smart Pick for Future Growth and How SN Capital Helps

Care Health Insurance, formerly known as Religare Health Insurance, is one of India’s fastest-growing standalone health insurance providers. With a strong presence across retail and group health segments, Care Health has built a reputation for customer-centric products, robust claim settlement processes, and a wide hospital network. As healthcare awareness rises and health insurance becomes a necessity in post-pandemic India, the company is well-positioned to capture increasing demand in both metro and tier-2 cities.

Investing in Care Health unlisted shares offers a rare chance to enter the health insurance sector at an early stage, before potential listing or valuation expansion. The company has shown consistent growth in its premium collections, customer base, and profitability. Its strong digital infrastructure and innovative health plans make it a standout performer in a highly competitive market. Given the long-term potential of health insurance in India, driven by low penetration and rising healthcare costs, Care Health presents a smart investment opportunity.

This is where SN Capital becomes your ideal investment partner. As a trusted name in unlisted and pre-IPO shares, SN Capital provides access to exclusive opportunities like Care Health, backed by detailed research, verified pricing, and professional guidance. Their platform simplifies the entire investment process—from initial inquiry and documentation to transaction execution and exit planning. With SN Capital, you get more than access—you gain confidence and clarity in your investment journey.

For investors looking to diversify into the booming health insurance sector, Care Health unlisted shares are a compelling option. With the expert support of SN Capital, this strategic investment becomes seamless, informed, and aligned with future growth.

%20Limited%20logo.png)

logo.png)

logo.png)