Chennai Super Kings (CSK)

Price: ₹188

About CSK Unlisted Shares

Overview of Chennai Super Kings and CSK Unlisted Share Price

Chennai Super Kings (CSK) is a franchise cricket team from Chennai, Tamil Nadu, that plays in the Indian Premier League (IPL). Founded in 2008, the team plays its home games in Maharashtra, Chidambaram, Chennai. After a two-year ban from the IPL from July 2015 due to its owner's alleged involvement in the 2013 IPL gambling scandal, the Chennai Super Kings returned to the league in 2018 and won the championship in their return season. This put them third overall and tied with the Mumbai Indians for the most IPL titles won. The team's captain is Mahendra Singh Dhoni.

According to the Brand Finance Report, the Super Kings' brand value was estimated at $65 million in 2018, making them the most valuable franchise in the IPL. According to a Brand Finance report, one of the biggest growth drivers for the IPL this year was not only the 11% increase in television viewership but also the fact that more than 200 million people watched the tournament on digital platforms such as Hotstar. "Cricket fans who were unable to get tickets to the live matches could watch the action at dedicated Fan Parks in 36 cities across the country. Family-friendly and free for all, the Fan Parks offered music, entertainment, and a range of merchandise stands, bringing an unprecedented stadium atmosphere to city centers," the Brand Finance report said.

Demerger from India Cement

India Cement on 26 September 2014 approved the demerger of Chennai Super Kings, the BCCI IPL franchise's 20/20 cricket tournament team, into a wholly owned subsidiary through a net asset transfer at cost. The new wholly-owned subsidiary will be formed on 1 January 2015. CSK shareholders will receive one CSK share for each India Cement share they hold.

India Cement transferred its shares in CSK to India Cement Shareholders Trust on 9 October 2015, the scheduled date of allotment. The company's shareholders were allotted one share for each India Cement share they held. However, since that period, CSK and Rajasthan Royals have had to serve two-year suspensions for their respective team presidents, Gurunath Meiyappan and Raj Kundra, for their involvement in suspicious gambling activities.

How did the price of CSK unlisted shares perform before and after the IPL?

If you watched our last webinar, we discussed in detail how the price of unlisted shares moves in the short and long term. We explained how demand and supply play a key role in determining the price of unlisted shares in the short term. Similarly, in the last three years, we have seen the CSK share price rise before the start of the IPL season and fall after the IPL ends, depending on the demand and supply.

CSK has the best track record in the IPL, with the Super Kings having won the IPL title four times (2010, 2011, 2018, 2021) and boasting the highest win percentage (59.83%) amongst IPL teams. Given CSK's past glory, there is an increased demand for unlisted shares as the start of the IPL draws near, as investors believe that CSK has a chance of winning the tournament or at least finishing in the top four. We also observed that if CSK wins or finishes in the top four, CSK's share price will rise in the unlisted market.

The analogy is very simple. If you look at the business model of IPL, when a team performs well, its valuation and brand value will increase, which ultimately increases the team's valuation or value per share. And if CSK wins the IPL, CSK's share price will rise further.

Only unlisted CSK shares are available in the unlisted market. So, if you want to participate in the success of IPL, you need to buy unlisted shares of CSK. Due to this, investors are rushing to buy unlisted CSK shares ahead of the 2022 IPL season, and enquiries regarding CSK share price are also on the rise.

In the last 6 months, CSK's share price/valuation has skyrocketed and achieved unicorn club status thanks to the sale of its new Lucknow team at the IPL for a staggering price of around Rs 7100 crore. This shows how much bidders are willing to pay to buy a team in the IPL.

The next IPL season starts on April 2, 2022, and we are already seeing an increased demand for unlisted shares of CSK among investors. Another reason for investors to buy unlisted shares of CSK is the upcoming media and broadcasting rights auction. CSK's share price may rise further in the unlisted market due to demand from bidders for media and broadcasting rights.

Price Trend of CSK Unlisted Shares Over the Past Year

If we look at the top unlisted companies, we can see that most of them have lost up to 50% of their share price in the last year, and CSK was no exception. However, CSK was less affected than the others. CSK's share price was around Rs 225 as of March 2022 and is currently trading at around Rs 180. Last year, the franchise lost 20% of its share price. The fall in CSK's share price could be due to the franchise's poor performance in the IPL, which reduced demand for franchise shares and hence the share price.

Current Market Valuation of CSK Unlisted Shares

According to Forbes, the CSK brand is worth $1.15 billion. CSK is the second most valuable franchise after the Mumbai Indians, valued at a whopping $1.3 billion.

With CSK's unlisted share price of $160 per share in the unlisted market and with around 3.6 billion shares outstanding, the market capitalization is around 570 billion yen, which seems undervalued compared to the last team sold in the market.

Chennai Super Kings (CSK) IPO News

CSK is not listed on the stock exchange, and the company's shares are not publicly traded. As the franchisee does not require operating funds, it has not shown any interest in raising funds from the stock market.

Frequently Asked Questions about CSK Unlisted Shares

1. Is CSK listed on a stock exchange?

Answer: No, CSK is not currently listed on a stock exchange. However, its unlisted shares are available in the market and can be easily purchased through Unlistedzone, India's leading unlisted platform.

2. Can I buy CSK shares?

Answer: Yes, you can easily buy unlisted CSK shares on the UnlistedZone platform.

3. What is the price of CSK shares?

Answer: As of May 3, 2023, the price of unlisted CSK shares is trading at Rs 168 per share in the market.

4. Does Dhoni own shares in CSK?

Answer: Yes, some reports say that Mahendra Singh Dhoni has bought a 15% stake in Rity, the sports marketing company that manages him and the Chennai Super Kings.

5. How can I check the unlisted CSK share price?

Answer: You can check the unlisted CSK share price on the UnlistedZone website or the UnlistedZone app.Note: Check the latest price of unlisted CSK shares on the UnlistedZone Android or iOS app.

UZ Review FY2018-FY2019

1. In 2018-19, CSK's finances saw a surge in revenue manifold with revenues increasing in the form of sponsorship rights, central rights, and gate collections. In 2017, Chennai Super Kings did not participate in the IPL due to corruption allegations, hence, revenues for 2018-19 cannot be compared with those for 2017-18.

2. The company made a profit of 111.2 million in the financial year 2018-19.

3. The paid-up capital is 3.0815 Cr as of 31 March 2019.

4. The company achieved an EPS of 3.61 in FY 2018-19. The company's stock is currently trading at a P/E ratio of 7.

5. Chennai Super Kings' market value is Rs 801 Cr at an unquoted market rate of Rs 26. In 2014, it was sold to India Cements for around Rs 600 Cr.

6. The company has several major investors, which are available in the shareholder structure mentioned above.

UZ Report 2019-20

1. Revenue for the year has declined from Rs 417 crore to Rs 356 crore, mainly due to lower revenue from the grant of central rights by the Board of Control for Cricket in India (BCCI). Accordingly, PAT has also come down from Rs 110 crore to Rs 50 crore.

2. During the financial year 2019-20, the mutual fund reduced its holdings from 108,08230 shares to 30,78949 shares.

3. Banks and insurance companies increased their holdings from 775,406 and 21,918,038 shares to 775,456 and 22,068,038 shares, respectively, in FY2019/20.

4. Radhakishan Damani purchased 1.7 million shares in November and December 2019.

UZ Review for FY20/21

1. Looking at CSK's financials for FY 2020-21, their overall revenue and profits for FY 2020-21 have declined compared to the previous year. This is mainly due to the decline in sales due to the COVID-19 pandemic.

2. The impact of the pandemic has also led to a decline in operating expenses from Rs 256 crore to Rs 180 crore, helping to maintain profitability.

Review of UZ's FY 2021-22

1. Spending on the IPL this year increased due to the tournament being split into two parts and the second part of the competition being held abroad, both of which contributed to the increase in spending during the period under review. The team's final victory also led to an increase in revenue.

2. The company plans to set up a high-performance center at its premises in Navallur to provide state-of-the-art training facilities for cricketers and sportspersons. The training facility will also include a sports complex and a cricket ground for the Chennai Super Kings' pre-match training sessions.

3. The Company applied for a franchise to the domestic T20 league run by Cricket South Africa on 13 July 2022 and has been granted a license to participate in the league in the city of Johannesburg. The inaugural tournament is scheduled to be held in January and February 2023.

IPL Outlook:

a) IPL has achieved significant milestones in 2021-2022. For example, the television rights for the Indian subcontinent have been sold to Walt Disney Company India-owned Star for INR 23,575 crore, and Viacom 18 has secured digital rights for INR 23,758 crore for 410 matches. This implies a nearly three-fold increase in revenues over the next five years compared to rights revenues over the past five years.

b) BCCI and IPL franchises earn around Rs 10,000 crore annually. 50% goes to the teams and 50% goes to the BCCI.

Fundamentals

Income Statement

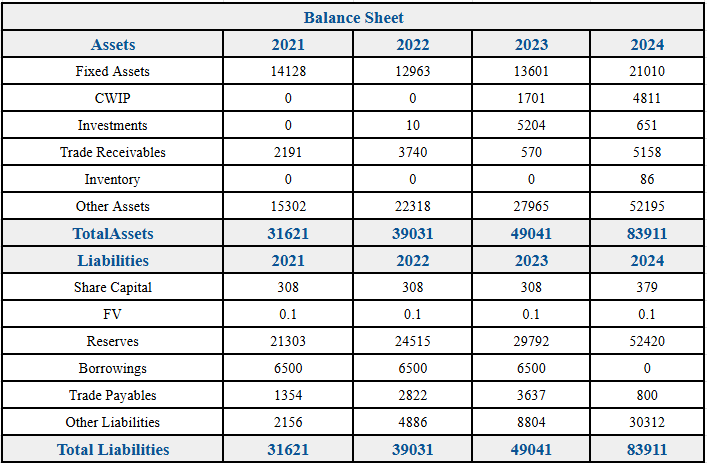

Balance Sheet

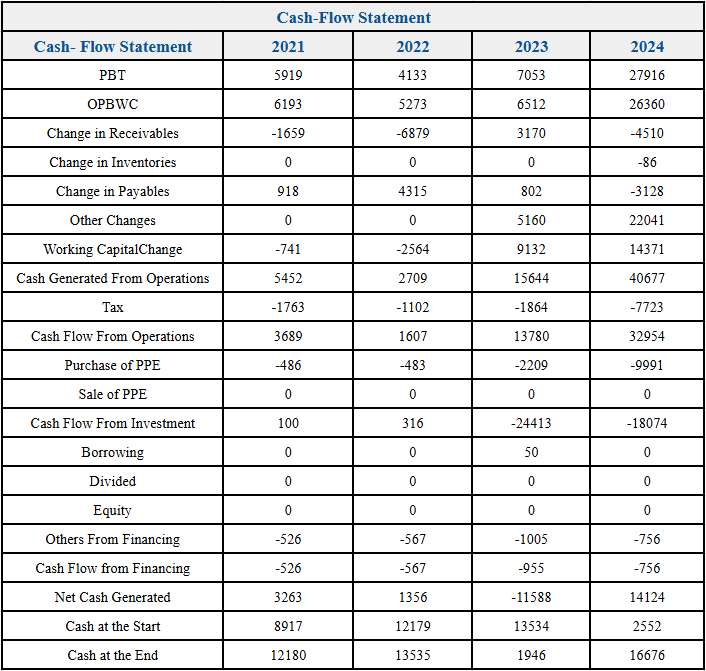

Cash Flow

Why CSK Unlisted Shares is a Smart Pick for Future Growth and How SN Capital Helps

Chennai Super Kings (CSK), one of the most iconic and successful franchises in the Indian Premier League (IPL), has evolved from just a cricket team into a powerful sports brand. With multiple IPL titles and a massive fan base across the globe, CSK has built immense brand equity. The franchise enjoys strong sponsorship deals, consistent on-field performance, and one of the highest brand valuations in Indian sports. As the IPL continues to expand its global reach and revenue streams, CSK is poised to benefit significantly.

Investing in CSK unlisted shares gives investors a chance to be part of a high-growth sports and entertainment business. With increasing broadcasting rights, sponsorship income, and brand merchandising, the commercial value of IPL teams continues to rise. CSK’s strong leadership, loyal fan following, and long-term revenue visibility make it a unique and promising investment opportunity. As interest in sports franchises grows and with the potential of future listings, early investors stand to gain significantly.

This is where SN Capital steps in as a reliable guide and facilitator. Specializing in unlisted and pre-IPO shares, SN Capital provides investors with access to high-demand opportunities like CSK. With verified pricing, detailed company insights, and a simplified investment process, SN Capital ensures a transparent and secure experience. From research and onboarding to documentation and exit planning, their expert team supports you at every step.

For investors looking to diversify into the dynamic world of sports and media, CSK unlisted shares offer unmatched potential. With SN Capital’s guidance and support, you can invest early in one of India’s top-performing franchises—confidently and strategically.

%20Limited%20logo.png)

logo.png)

logo.png)