Fino Paytech Limited

Price: ₹118

About Fino Paytech Limited Private Equity

(i) Fino Paytech was incorporated on July 13, 2006, and is headquartered in Mumbai with offices across India. It is a business and banking technology platform combined with a comprehensive service delivery channel, with a vision to meet all the financial services needs of customers and be the preferred choice.

(ii) Fino Paytech is an institutionally led company owned by international and Indian investors. The company has positioned itself as a thought leader, innovator, and implementer of technology solutions for institutions such as banks, microfinance institutions, government agencies, and insurance companies. As an alternative banking channel, Fino Paytech enables seamless end-to-end customer acquisition and support.

(iii) FINO PayTech Limited Group is primarily engaged in providing technology-based solutions and services related to financial inclusion. It is a business and banking technology platform combined with a broad range of service channels. The Group includes a Non-Banking Financial Company i.e. a Non-Deposit Taking Company or Holding Company ("NBFC-ND") registered with the Reserve Bank of India (RBI). Organized as a Joint Liability Group (JLG), it works to provide finance to poor women in rural India. The Group serves institutions such as banks, microfinance institutions, government agencies, and insurance companies. This group includes banks that offer services such as current and savings accounts, money transfers, business communications, mobile banking, bill payments, and sales of third-party financial products. The bank provides various types of financial services to the rural poor and underserved to help them become financially independent.

What does the company do?

A) Customer Onboarding Solutions

(i) Fino Paytech has developed an application that effectively acquires small customers.

(ii) Unlike the banking model, where customers need to visit a branch in person, Fino Paytech's customer acquisition system allows customers to onboard/acquire at the doorstep. The process is quicker and easier for both the customer and the bank while still maintaining the essence of banking. (iii) The enrolment station typically consists of a laptop connected to a webcam, fingerprint scanner, and signature pad (optional).

B) Hardware Solutions

(i) Fino Paytech provides a full suite of biometric products for enrolment, storage, and verification while managing all back-end system elements. This enables the company to develop and deliver unique financial inclusion applications.

(ii) The technology enables Fino Paytech's customers to offer a wide range of simple and accessible solutions across a range of products, including handheld devices, biometric chip cards, back-end switches, and micro-deposit machines.

C) Operational Solutions

The operational solutions team manages data messages and provides the information required for day-to-day operational planning and management. Clients can use some of Fino Paytech's pre-built reports or request custom reports.

D) Services

(i) Advisory Services

(ii) Financial Literacy

Who do they serve?

A) Banks

(i) Joint Liability Group Loans – JLG in the banking system is a lending model that allows a group (usually 5 people) to borrow for income-generating activities by forming a group where the members of the group guarantee each other’s loans. FINO has been offering JLG loans since 2008 on behalf of various banking partners under their liability. FINO’s solution provides a platform for group-based micro loan sourcing and servicing to customers.

(ii) Fixed Term Deposits – Fixed-term deposits are an ideal way to invest a small amount of money every month and get a large balance at maturity. Fino Paytech is the first and only company to offer fixed deposits for small customers, making it an exclusive savings product for this customer segment.

(iii) Remittance – It provides a fast, reliable, and convenient platform for domestic remittance from remitter to recipient through intrabank (home bank), interbank (NEFT), and IMPS facilities.

B) Government

(i) MNREGA – Fino Paytech provides a pan-India card that can be used for domestic payments in over 50,000 villages across the country. The use of biometric technology has significantly reduced the opportunities and instances of misuse and abuse in payments to citizens.

(ii) Social Security Systems – Many state governments are using Fino Paytech architecture based on the use of fingerprints as authentication across the country to provide social security systems to their citizens. This is expected to result in significant savings in government resources.

C) Insurance Fino Paytech's cutting-edge technology solutions have transformed the healthcare microinsurance sector in India. The solutions enable insurers to reach customers at the bottom of the pyramid and address their unique financial needs while remaining financially viable. Rashtriya Swasthya Bima Yojana (RSBY) is a cashless national health insurance scheme introduced by the Government of India. The program aims to protect below-poverty-line (BPL) households from the financial burden of ill health and hospitalization.

Fact – Fino Paytech has enrolled over 25 million families in the RSBY program. It was licensed as a payments bank in 2

Fundamentals

Income Statement

Balance Sheet

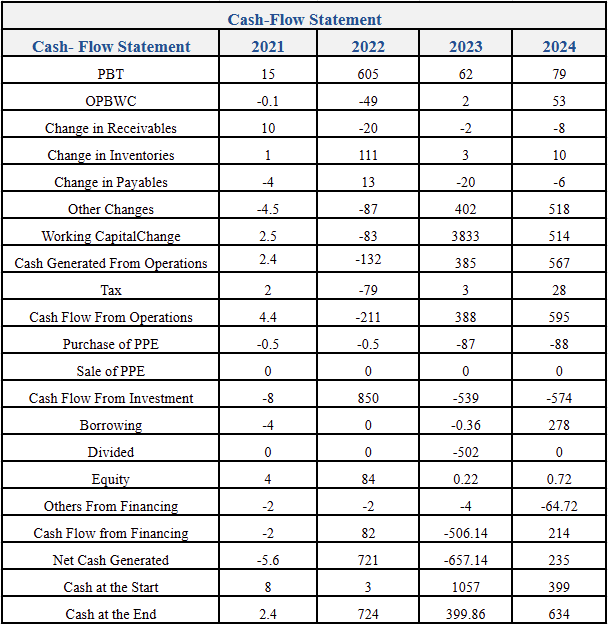

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)