HDB Financial Services Limited

About HDB Financial Services Limited Unlisted Equity

(i) HDB Financial Services (HDBFS) is a leading non-banking financial company (NBFC) serving the growing needs of an aspiring India, serving both retail and corporate customers. The company is a systemically important non-banking non-depository financial company (NBFC).

(ii) The company was incorporated in 2008 and is a well-established company with strong capitalization. HDBFS has CARE AAA and CRISIL AAA ratings for long-term debt and bank loans, and A1+ ratings for short-term debt and commercial paper, making it a strong and reliable financial institution.

(iii) Our Products: Our current product portfolio consists of three major categories: loans, fee-based products, and BPO services.

Loans

Consumer Loans -

The company offers white loans (washing machines and refrigerators), brown loans (televisions, audio equipment, and similar home appliances etc.), and digital products (mobile phones, computers, laptops, etc.). The company also offers loans for homes.

The consumer loan portfolio includes:

1. Gold loans

2. Consumer credit for durable goods

3. Car Loans

4. Personal Loans.

5. Loans against MFS.

Business Loans:

Small businesses require funds for working capital, purchasing new products, or setting up new factories. The company offers secured and unsecured loans to these SMEs.

Equipment Financing:

The company offers loans for the purchase of new and used vehicles or vehicles that generate income for the borrower e.g. trucks, tractors, etc.

Paid Products

The company is a registered insurance agent selling life and non-life insurance products of HDFC Life and HDFC Ergo to its customers.

BPO Services

Debt Collection Services – The company has an agreement with HDFC Bank to collect debts of borrowers. The company has set up 15 call centers across the country with 5,000 seats each.

Infrastructure

As of March 31, 2020, HDB Financial Services has 1,468 branches in 1,070 cities across India. The company has 1,468 branches in 1,070 cities across India as of March 31, 2020.

Key Events in the History of HDB Financial Services Unlisted Stock:

a) 2007: HDB Financial Services is incorporated as a non-banking financial company (NBFC) in Mumbai, India.

b) 2008: The company launches its first product, property-backed loans.

c) 2010: HDB Financial Services introduces personal loans and two-wheeler loans.

d) 2012: The company expands its product portfolio to include commercial vehicle loans, gold loans, and securities-backed loans.

e) 2015: HDB Financial Services becomes a subsidiary of HDFC Bank.

f) 2016: The company launches credit cards and enters into insurance sales. g) 2017: HDB Financial Services crossed the milestone of 1 million customers.

h) 2018: The company collaborates with fintech startups to improve its digital capabilities.

i) 2019: HDB Financial Services crossed the milestone of 10,000 employees and introduced a new brand identity.

j) 2020: The COVID-19 pandemic has impacted the company's operations and financial performance, but HDB Financial Services has quickly adapted by launching new digital products and services.

Despite the challenges brought about by the pandemic, HDB Financial Services continues to grow and innovate and remains one of India's leading NBFCs.

Notable performance of HDB Financial Services Unlisted Equity:

a) HDB Financial Services has a strong presence in both urban and rural India with over 1,400 branches across the country.

b) The company has a diversified portfolio of financial products and services, including personal loans, business loans, car loans, mortgage loans, gold loans, and credit cards.

c) HDB Financial Services has a customer-centric approach and has been recognized for its excellent customer service. In 2019, the company received the ET BFSI Award for ‘Excellence in Customer Service’.

d) The company has a strong digital presence and has been recognized for its innovative use of technology. In 2020, HDB Financial Services received the IDC Digital Transformation Award for ‘Excellence in Omniexperience Innovation’.

e) HDB Financial Services has a robust risk management framework and has been recognized for its sound risk management practices. In 2020, the company won the ERM World Summit Award for "Best Implementation of Risk Management Framework in Financial Services".

f) The company attaches great importance to sustainability and Corporate Social Responsibility (CSR) and has been recognized for its CSR efforts. In 2020, HDB Financial Services won the Golden Peacock Global Award in the "Corporate Social Responsibility" category.

HDB Financial Services Unlisted Shares Financial Performance 2022-23

1. Our assets under management (AUM) increased to 66,383 as at 31 March 2023 from 61,444 a year ago.

2. The company achieved a turnover of Rs 12,403 crore. Lending business contributed Rs 9,769 crore, and BPO services contributed Rs 2,633.9 crore.

3. The company's loan book stands at Rs 2,422.78 crore as of March '22-'23.

4. PAT increased to 195.9 billion from 101.1 billion.

5. Earnings per share for 2022-23 at 25.6 times. The book value is Rs 145 billion in 2022-23

HDB Financial Services Unlisted Equity Financial Performance 2021-22

1. Loan disbursements for FY21-22 stood at Rs 29,033 billion against Rs 24,000 billion in the previous fiscal.

2. Our Assets Under Management (AUM) declined to Rs 6,144.4 billion as of 31 March 2022 from Rs 6,156 billion in the previous fiscal. Secured Loans – 44,662.81 (76%) Unsecured Loans – 13,768.14 (24%)

3. As of March 31, 2022, the company's outstanding loans stand at Rs 1,951.72 crore, with loans extended from public sector banks, private sector banks, mutual funds, insurance companies, financial institutions, etc.

4. The company's turnover for FY 2021-22 is Rs 11,306 Cr. achieved. Of this, loans account for Rs 8,362 Cr and BPO for Rs 2,363 Cr.

5. Earnings per share for FY 21-22 is 12x.

6. Book value per share for FY 21-22 is Rs 120.

HDB Financial Services Unlisted Equity Financial Performance 2020-21

1. FY 2020-21 has been a tough year for the Indian economy due to the challenges posed by COVID-19. Due to this, lending has slowed this year, growing at just 2.5% compared to the previous average of 25%.

2. The lending business grew 3.2% and BPO service contracts grew 5% in FY2020- 21 compared to the previous fiscal year.

3. As per the auditor-audited unconsolidated accounts for the financial year ending March 31, 2021, the company's debt-to-equity ratio stands at 6.53 times.

4. The ratings of banking facilities, NCDs, short-term notes, subordinated notes, and perpetual bonds are 'stable' and of good quality.

5. PAT declined from Rs 1,000 crore to Rs 391 crore in FY20-21, mainly due to 'impairment of financial instruments,' but increased from Rs 144 crore to Rs 360 crore due to higher non-performing loans due to COVID-19.

Fundamentals

Income Statement

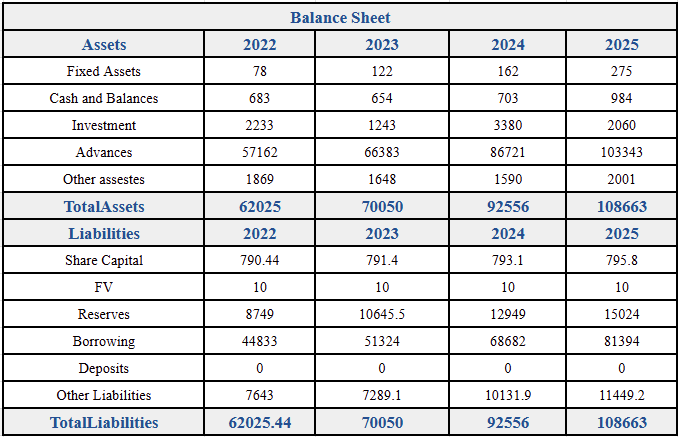

Balance Sheet

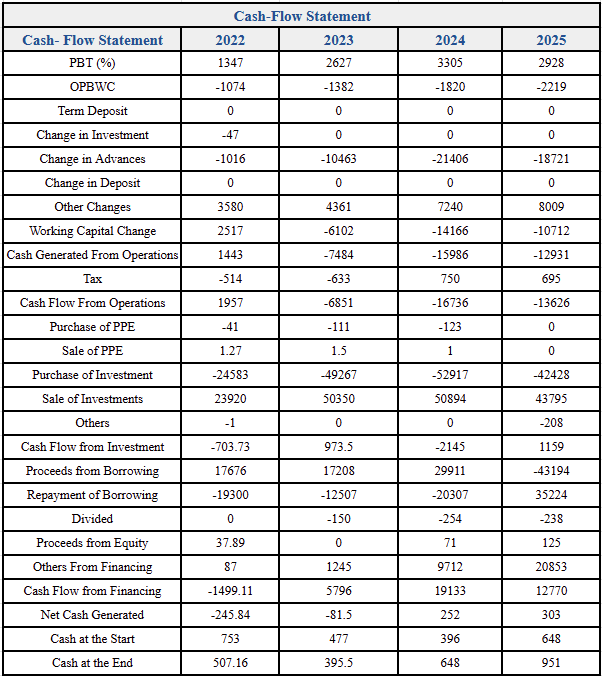

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)