Hero Fincorp Limited

Price: ₹1,394

About Hero Fincorp Limited Unlisted Shares

Overview of Hero Fincorp and Hero Fincorp Unlisted Shares

(i) Hero FinCorp Limited (HFCL) was incorporated in 1991 as Hero Honda FinLease Limited. Due to a change in ownership of its parent company Hero MotoCorp Limited (formerly Hero Honda Motors Limited), the company name was changed to Hero FinCorp Limited.

(ii) HFCL is engaged in the business of financing, leasing, invoice discounting, and other financial services. HFCL has a wholly-owned subsidiary, Hero Housing Finance Limited, which is in the business of providing home loans.

(iii) As of 2020, HFCLS retail operations are present across 938 franchisees and services are available at 4000+ touch points across 1900+ cities, towns, and villages. HFCL provides real estate, SME, and start-up loans across 50 locations in the non-retail sector and processes over 800 applications every month.

(iv) Hero FinCorp Subsidiaries: The Company has a wholly owned subsidiary called Hero Housing Finance Limited ("HHFL"). HHFL commenced its lending business in April 2018. The Company is a full-service housing finance company providing hassle-free home loans to customers across India and its products include:

(i) Housing Loans,

(ii) Loans against Property etc. HHFL has demonstrated phenomenal growth and disbursed loans worth INR 556.75 crores in its first full year of operations i.e. FY 2019. During the year, Hero-Fin Corp invested INR 200 crore in HHFL by subscribing to 20,000,000 ordinary shares of INR 10 each on a rights basis.

Key highlights for 2019

(i) Hero Motorcorp Limited (HMCL) holds a 41.03% stake in Hero-Fin Corp.

(ii) Hero-Fin Corp's turnover and net profit have increased by 47.85% and 49.01%, respectively, over the last three years.

(iii) Hero-Fin Corp's capital adequacy ratio stands at 19.03%, well above the RBI norm of 15%.

(iv) ICRA and CRISIL Limited have rated the various facilities availed by the company at AA+.

(v) Hero-Fin Corp receives financial, operational, and management support from Group HMCL (Group HMCL includes the Group's investment companies and individual promoters).

(vi) Hero-Fin Corp has a strong institutional investor presence, such as Credit Suisse (Singapore) Limited, which holds 2.58% of the company, and ChrysCapital, which holds 10.56% of the company.

Key highlights for 2020

(i) During FY2020, Hero-Fin Corp became the leading two-wheeler finance company in India.

(ii) During FY2019- 20, Hero-Fin Corp achieved the milestone of serving 5 million customers, establishing a network across 2000 locations, and registering a 40% YoY growth in loan disbursements.

(iii) Hero-Fin Corp disbursed loans worth 17,827 crores during FY2019- 20.

(iv) Total assets under management as of March 31, 2020, are 25,182 crores.

(v) PAT was $310 million, up 16% as compared to $268 million last year. Employee strength as of March 31, 2020, is over 7,500.

(vii) Hero-Fin Corp has recommended a final dividend of Rs 2.55 per equity share for the financial year ended March 31, 2020.

Key Financial Performance of Hero FinCorp Unlisted Equity for FY22- 23

1. Net Interest Income: Net interest income increased by 38% from Rs 2,563 crore in FY22 to Rs 3,546 crore in FY23. This growth suggests an improvement in interest-earning assets or an increase in interest rate spreads.

2. Other Income: Other income also registered a growth of 38% from Rs 492 crore in FY22 to Rs 680 crore in FY23. This growth can be attributed to factors such as fee income, commission, or profits from non-core business activities.

3. Total Revenue: Hero-Fin Corp's total revenue grew by 38.3% from Rs 3,055 crore in FY22 to Rs 34,226 crore in FY23. This significant increase indicates a robust track record of generating revenue from both interest and non-interest sources.

4. Operating Expenses: Operating expenses increased by 54.3% from €1,374 million in FY22 to €2,121 million in FY23. The increase reflects higher expenses related to operational activities, including expansion, inflation, and higher administrative costs.

5. Profit before Provisions: Profit before Provisions increased by 25.2% from €1,681 million in FY22 to €2,105 million in FY23. This growth indicates an improvement in the company's profitability before provisions.

6. Provisions: Provisions declined 33% from Rs 1,800 crore in FY22 to Rs 1,200 crore in FY23. The decline suggests a reduction in the amount set aside for potential credit losses or contingent liabilities, which may be a positive sign of improvement in credit quality or risk management.

7. Profit after Provisions: Profit after provisions has turned around from a loss of Rs 119 crore in FY22 to a profit of Rs 950 crore in FY23. This significant improvement indicates that the reduction in provisions is having a positive impact on the company's overall profitability.

8. Profit after Tax (PAT): Profit after Tax (PAT) has also shown a significant improvement, increasing from a loss of Rs 194 crore in FY22 to a profit of Rs 457 crore in FY23. This positive development indicates that the company's performance is recovering significantly. Overall, Hero-Fin Corp has demonstrated better performance in FY23 compared to FY22 with significant increases in net interest income, other income, total profit, and profitability. The reduction in provisions and turnaround from loss to profit after provisions are positive indicators of improving asset quality and risk management.

Hero Fincorp's Unlisted Share Price Movement

Hero Fincorp's unlisted share price has soared from Rs 980 to Rs 1,060 in the past one year. Most of this increase has occurred in the last month. The share price rose as both profit after tax (PAT) and non-performing assets (NPA) declined. Hero-Fin Corp has seen a significant increase in revenue which has no doubt helped boost investor confidence and attract market attention. This growth indicates that the company is well-run, resulting in higher sales and an overall improved financial position. Positive sales are seen as an indication of healthy growth in the business, pleasing investors and boosting the share price.

Current valuation of Hero FinCorp's unlisted stock in the market.

In the current unlisted market, Hero-Fin Corp is priced at Rs 1,200 per share. Hero-Fin Corp's book value is Rs 415 per share as on March 31, 2023. Hence, the P/B multiple stands at 2.89x, which appears fully priced in.

Fundamentals

Income Statement

Balance Sheet

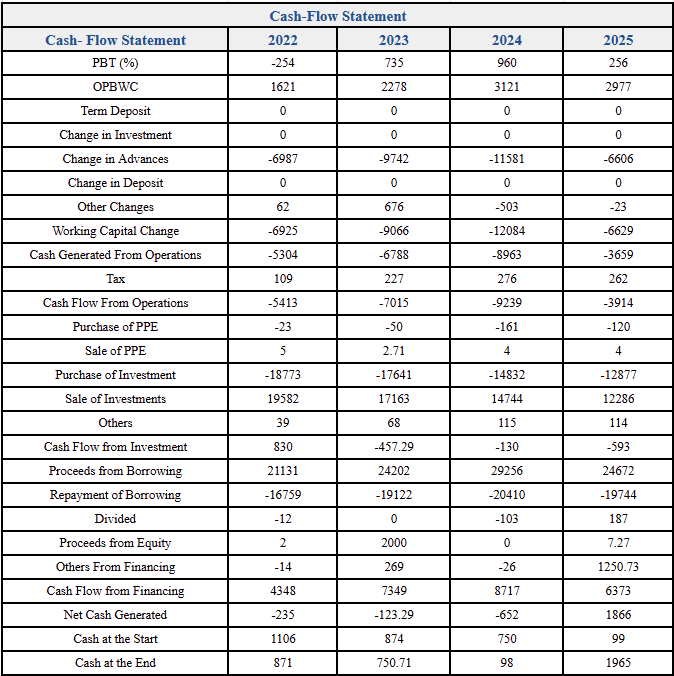

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)