Motilal Oswal Home Finance Limited

Price: ₹17

About Motilal Oswal Home Finance Limited Unlisted Equity

(i) Motilal Oswal Home Finance (formerly Aspire Home Finance Corporation Limited) is a professionally managed housing finance company incorporated on 1 October 2013, with a unique combination of financially sound and technically experienced promoters, who are renowned for their work ethics in their field and their strong execution skills.

(ii) Motilal Oswal Home Finance operates on a business philosophy of financial inclusion by providing access to long-term housing finance to Low and middle-income (LMI) families in India. Motilal Oswal Home Finance is a subsidiary of Motilal Oswal Financial Services Limited (MOFSL), a diversified financial services company focused on wealth creation for all its customers, including B. Institutional clients, Corporate clients, HNI, and Individual clients. To Motilal Oswal Home Finance Ltd. Does (MOHFL) lend?

a) Provides housing loans to individuals and families for the purchase, construction, and expansion of residential properties.

b) Provides loans and mortgages for home repairs and renovations to families belonging to the categories of "credit beginners", "self-employed" and "cash employees" where formal income certificates and credit reports are not readily available and make repayments. The capacity of such families is assessed based on their cash flow and the assessed internal scorecard.

Presence as of 31 March 2022:

MOHFL is active in 12 states, namely Haryana, Uttar Pradesh, Delhi, Maharashtra, Gujarat, Madhya Pradesh, Karnataka, Rajasthan, Chhattisgarh, Tamil Nadu, Telangana, and Andhra Pradesh. MOHFL currently has 110 branches across these 9 states.

Loan books outstanding as of 31 March 2022

MOHFL's loan book for FY2022 is R3,435 million, with the loan book declining year-on-year as NPA books were sold to ARCs during the year.

Underwriting:

In the lending business, underwriting is the most important parameter to pay attention to when investing in a company. Underwriting is the process of lending. If a company has a robust underwriting process, the chances of NPAs are significantly reduced. Now let's see how MOHF gives loans:

a) MOHFL's loan approval process consists of four levels of approval based on the size of the loan.

b) Approval of loan applications is done by various agencies, ranging from the Cluster Credit Unit to the National Credit Unit. Approval above a certain limit is given by the Chief Operational Officer. The additional layer of internal legal and technical agencies makes the lending process more robust.

c) A dedicated Risk Containment Unit (RCU) has been set up within the company to minimize fraudulent activities related to revenue documents, profiles, and collateral.

Borrowing:

Lending is a business that needs money to give money. MOHF first collects funds and then distributes them to people in the economy so that they can buy new homes or renovate them. So how does MOHF collect funds?

a) In the form of term loans from banks.

b) NCDs through the issuance of commercial papers. MOHFL's total loan outstanding stood at Rs 1,860 crores as of 31st March 2022. The cost of borrowing for FY22 was 9.60%. Journey with Motilal Oswal Home Finance

2014:

(i) Commenced operations on 22nd May 2014.

(ii) The first withdrawal was posted at the Akola branch in June 2014.

(iii) Loan amount crossed Rs 500 crores.

2015:

(i) Presence in 14 locations.

(ii) Total Employees: 160.

(iii) Loan book of 357 Cr with 3565 active accounts.

(iv) Year-end PAT of 18 Cr. CRISIL upgraded Long Term Credit Rating to 'A+/Stable' from 'A/Stable'. Loan portfolio of over 550 Cr and active loan accounts of 5,500 Cr. Active across 23 locations.

2016:

(i) Employee strength of 500 across 51 locations.

(ii) PAT for the year at 40 Cr.

(iii) First 50 Brands 2016 Award from WCRC. (iv) Expansion to 62 locations.

2017:

(i) Second place award for best-leading credit institution under CLSS for EWS/LIG by the Ministry of Housing & Urban Poverty Alleviation.

(ii) Expansion to 6 new States with 121 locations and 1,049 employees.

(iii) Loan book of Rs 4,165 Cr with 46,142 active accounts.

2018:

(i) Loan book of 4682 Cr.

(ii) Capital infusion of 150 Cr by MOSFL.

(iii) Strengthening of the core team.

(iv) Credit and Risk Strengthening

Key highlights for FY 2017/18

(i) Loan book – 4,863, +17% YoY

(ii) NIM – 4.1% NNPA – 3.3%

(iii) Delivery coverage – 35%.

(iv) Debt to capital ratio – 4.9x.

(v) Cost to income – 38%. (vi) Capital Adequacy Ratio – 38%

Key Highlights for FY18/19

(i) Through Motilal Oswal Home Finance (previously known as Aspire Home Finance Corporation), we offer pure retail affordable housing.

(ii) During the year, we focused on restructuring our housing finance business processes, structures, people, and people to strengthen the business. As a result, we adopted a conservative approach towards disbursements, resulting in disbursements of Rs 290 crore in FY19.

(iii) As of March 2019, our outstanding loans stood at Rs 4,357 crore across over 52,000 households.

(iv) Average loan size remained low at Rs 85 lakh in FY19. They have established a vertical organizational structure consisting of sales, credit, recovery, and legal departments.

(v) The introduction of cluster-level lending, along with a five-tiered loan approval system based on loan ticket size and differentiated pricing methodology for loans based on risk type, is expected to lead to improved lending in the future.

(vi) Macroeconomic events like demonetization, RERA, GST, and lack of a collection engine, coupled with a lack of vertical structure, are leading to an increase in NPAs. This year, they have written off loans worth Rs 290 crore in FY19 as part of their conservative policy. Now with a strong recovery and legal team in place, they are expecting recovery from pool write-offs.

(vii) Motilal Oswal Group infused Rs 200 crore during the year, taking the total capital to Rs 850

equivalent to Rs 1000 crore.

(viii) About 57% of the loans were from capital markets in the form of NCDs and 43% from banks.

Key highlights for FY 2019-20

(i) As of March 2020, the loan book stood at Rs 3,667 crore against 47,900 households.

(ii) During FY 2020, MOHF sold assets worth Rs 595 crore to Phoenix ARC for Rs 293 crore, resulting in a significant reduction in GNPA and NNPA rates to 1.81% and 1.36,% respectively. This has enabled it to raise funds at a lower cost.

(iii) This year, the company has expanded all four pillars of its lending business - sales, credit, collections, and legal. The company now employs 430 people across these divisions. Learning from the past, it is also working hard to streamline lending.

(iv) MOHFL's credit rating has also been upgraded amid a challenging environment, due to several positive changes. CRISIL upgraded MOHFL's rating to AA- (stable) from A+ (stable).

(v) During FY 2019-20, MOHF provided loans worth Rs 190 crore for the purchase, construction, repair, and renovation of houses. Loan disbursements were made under a "collateral first" policy and subject to several strict checks and balances. It can be seen that the company is focusing on lending to reduce NPAs in the coming years.

Key highlights for FY 2020/21

(i) The loan book as of March 31, 2021, is Rs 3,512 crore

(ii) Net assets as of March 31, 2021, is Rs 910 crore

(iii) Profit for FY 2021 was Rs 4,000 crore.

(iv) NIM -6.1%.

(v) GNPA - 2.2% and NNPA - 1.5%

(vi) Expenses in FY21 grew 42% YoY to Rs 273 crores.

(vii) Revenues raised by 7.5% to Rs 1,477 crores in FY21.

Key highlights for FY21- 22

1. The company achieved its highest ever PAT in its operational history of Rs 9,500 crores in FY22. Last year's profit was Rs 4,000 crores. This is possible as it has reduced its financing costs by around Rs 60 billion in FY22 compared to FY21.

2. In FY22, Motilal Oswal Home Finance disbursed loans worth approximately INR 643 crore, up 133% YoY.

3. In FY22, the company expanded its sales team, which now has over 600 employees. In addition, it expanded into three new regions - Haryana, Delhi, and Uttar Pradesh.

4. As of March 31, 2022, the loan amount is JPY 348.5 billion to 48,412 households.

5. Borrowing costs have also been reduced by 105 basis points in FY22 and are now at 8.2%.

6. NIM stood at 7.3% in FY22

7. Gross NPAs were 1.6% and net NPAs were 0.9% as of March 31, 2022.

8. The PMAY portal, launched in 2021 for digital customer acquisition, received a very good response in FY22.

9. Parent company Motilal Oswal Financial Services has made a capital infusion of Rs 850 crore in the company in FY22.

10. MOHFL's total borrowings as of March 31, 2022, stood at Rs 2,660 crore, within the permissible limit of 12 times net capital.

11. Book value as of March 31, 2022, is Rs 1.67 per share. Motilal Oswal Home Finance has a CMP of Rs 12 per share. Hence, the P/B ratio is 7.18x (which is overvalued).

Key highlights for FY22- 23

1. Net interest income (NII) was Rs 312.86 crore, a significant improvement from Rs 271 crore in FY22.

2. The company's total expenses came down to Rs 356 crore from Rs 480 crore.

3. The company's provisions will reach €18.93 million in 2022-23.

4. Net profit for 2022-23 is €136 million, up 43.15% compared to €95 million the previous year, due to a reduction in provisions of €54 million.

5. The company's loan book also increased by 9% to €3.808 billion.

6. As of March 31, 2023, GNPA is 1.07, and Net NPA is 0.55%.

7. Motilal Oswal Home Finance has a book value of 1.9. This results in a price-to-book ratio (P/B) of 5.13x, suggesting that the company may be overvalued.

Key highlights for FY23- 24

1. Interest income has increased by Rs 45 million to Rs 558 million in 2024 from Rs 513 million in 2023. Net interest margin (NIM) is now at 7.6%.

2. Finance costs increased by 315 billion from 218.5 million in 2023 to 250 million in 2024. Operating expenses increased by 30%.

3. Provisions decreased by *7 billion from 19 million in 2023 to 12 million in 2024.

4. In March 2024, Gross Non-Performing Assets (GNPA) continued to improve, standing at 0.86% and Net Non-Performing Assets (NNPA) at 0.55%.

5. Profit after tax (PAT) is projected to decline marginally by Rs 4,000 crore from Rs 136 crore in 2023 to Rs 132 crore in 2024.

6. As of March 2024, the company's loan portfolio stood at Rs 4,048 crore, registering a growth of 6% YoY.

7. Currently, the company has 110 stores spread across 12 states/union territories.

8. FY24 expenditure has crossed Rs 1,000 crore to Rs 1,018 crore.

9. The company's book value is 2.13. This translates into a price-to-book ratio (P/B) of around 7 times, suggesting that the company is overvalued.

Fundamentals

Income Statement

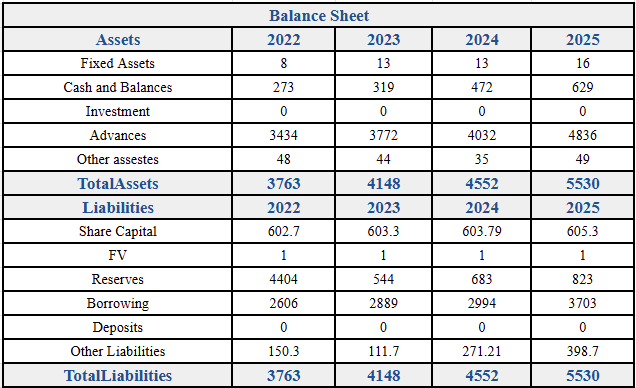

Balance Sheet

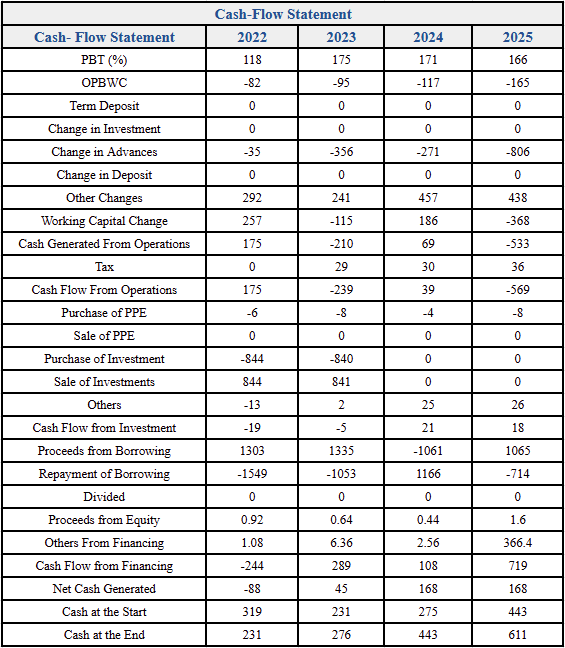

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)