Philips Domestic Appliances

Price: ₹583

About Philips Domestic Appliances India Unlisted Shares

Philips Domestic Appliances India Limited is a renowned player in the consumer durables sector, offering a unique investment opportunity through private equity. The company was incorporated on July 17, 2020, as a wholly owned subsidiary of Philips India Limited and has been a leader in the home appliances business since its demerger from Philips India effective July 1, 2021.

Demerger and Corporate Structure:

The spin-off, approved by the National Company Law Tribunal in Mumbai and Kolkata, was a strategic move to strengthen focus and growth in the home appliances segment. The spin-off resulted in the formation of Philips Domestic Appliances India Limited, which operated parallel to Preethi Kitchen Appliances Private Limited. Following the spin-off, Philips India shareholders were allotted one ordinary share of Philips Domestic Appliances India Limited for each share held. This is a decision that underscores the company's commitment to preserving shareholder value.

Business Model and Product Portfolio:

Philips Domestic Appliances India Limited is uniquely positioned in the distribution and sale of a wide range of consumer goods. The company's diverse portfolio includes kitchen appliances such as juicers, air fryers, food processors, and coffee machines, home care products such as vacuum cleaners and air purifiers, garment care products such as irons, and personal care items such as facial shavers. In addition, the company has expanded its offerings into the electronics sector and now also offers televisions, monitors, projectors, headphones, and speakers. With this wide product range, Philips Domestic Appliances has established itself as a comprehensive provider in the consumer goods market.

Financials and Market Presence:

As of March 31, 2022, the company's paid-up capital was INR 575 million, divided into 57.5 million equity shares of INR 10 per share. The strategic spin-off and focused business approach have positioned Philips Domestic Appliances India Limited to capture potential growth and profitability in the highly competitive consumer durables market.

Investing in Philips Domestic Unlisted Shares:

Investing in unlisted Philips Domestic Shares offers an opportunity to be part of a company with a strong heritage, diversified product portfolio, and solid market presence. As the company continues to innovate and expand its product line, Philips Domestic Appliances could be an attractive proposition for investors seeking long-term growth prospects in the consumer durables space.

Fundamentals

Income Statement

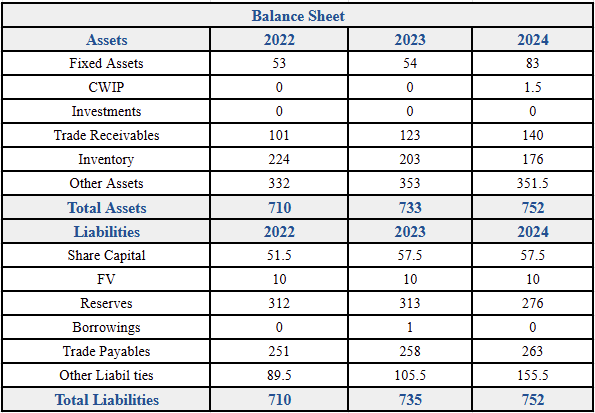

Balance Sheet

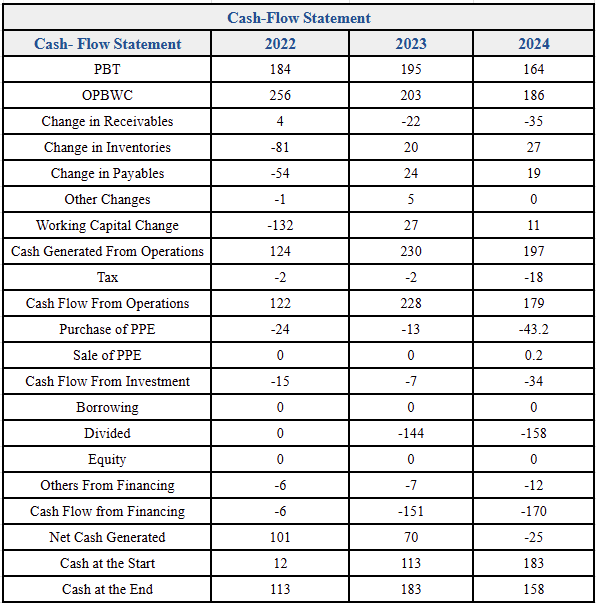

Cash Flow

Why philips domestic Unlisted Share is a Smart Pick for Future Growth and How SN Capital Helps

Philips Domestic Appliances, now operating independently after its spin-off from Royal Philips and backed by Hillhouse Capital, is emerging as a strong player in the consumer appliances sector. Known for its premium quality and innovation, the brand continues to dominate across product categories like kitchen appliances, air purifiers, and garment care solutions. As consumer lifestyles shift towards smart and energy-efficient solutions, Philips Domestic is well-positioned to benefit from rising demand in both urban and semi-urban markets.

Investing in unlisted shares of Philips Domestic offers a unique early-mover advantage. Unlike listed stocks, unlisted shares often trade at a discount to their intrinsic value, allowing investors to capitalize on growth before a potential IPO or valuation jump. The company’s strong brand equity, international market presence, and stable financials make it a smart pick for long-term investors looking for exposure to the fast-growing home appliances segment.

This is where SN Capital comes in as a trusted partner. Specializing in unlisted and pre-IPO shares, SN Capital provides retail and HNI investors with curated access to high-potential opportunities like Philips Domestic. From up-to-date pricing and in-depth company insights to a seamless transaction experience, SN Capital ensures that investing in private markets is both accessible and transparent.

With its deep research capabilities and client-focused approach, SN Capital helps investors make informed decisions, reducing the complexity of dealing with unlisted equities. For those looking to diversify their portfolio and invest in future-ready companies, Philips Domestic Appliances—backed by the expertise of SN Capital—represents a compelling opportunity.

%20Limited%20logo.png)

logo.png)

logo.png)