RKB Global

Price: ₹124

About RKB Global Limited

A) Company Overview:

(i) Established in 1932, the company initially focused on trading of raw steel materials and later on, focused on manufacturing and branding.

(ii) Manufacturing Facilities: With state-of-the-art plants in Maharashtra and Gujarat.

(iii) Strategic Partnerships: Collaboration with Tata is notable for offering premium products.

(iv) Innovation and Expansion: Introduction of import substitution products like Welding Wire and Bright Steel.

B) Product Portfolio:

(i) Trapezoidal Profile Sheets and Color Coated/ Galvanized Corrugated Sheets for the roofing industry. Highlighting RKB's contribution to construction and infrastructure with durable and aesthetic solutions.

(ii) MS ERW pipes and GP pipes are used in a wide range of applications from plumbing to engineering, demonstrating the company's ability to manufacture components essential for industrial and residential construction.

(iii) Wire drawing and bundling wire, bright rod, welding electrodes, and MIG wire are essential for various manufacturing operations and automotive and engineering projects, highlighting RKB's role in supporting critical industrial activities.

(iv) The introduction of prefabricated building materials demonstrates RKB's focus on modern building requirements, providing efficient and customizable solutions for warehouses, sports facilities, factories, and multi-story buildings.

(v) In addition to a comprehensive product portfolio, RKB Global Ltd is also involved in mining, owning a mine in Goa on a 25-year lease agreement with an annual export capacity of 150,000 tonnes. The mining project highlights RKB's commitment to vertical integration. This ensures a steady supply of raw materials to its manufacturing plants, allowing the company to maintain control over quality and costs. This strategic move will not only diversify RKB Global's business but also strengthen its position in the steel industry by leveraging its full potential. Resources have been depleted.

C) Financial Highlights:

(i) Growth Trajectory: Demonstrating significant revenue and EBITDA growth from FY2020- 21 to FY2024- 25.

(ii) FY2020- 21 to FY2022- 23: Steady growth in total revenue, operating profit, and net profit with significant upside in financial projections for FY2023- 24 and FY2024- 25.

(iii) Funding Plans: The Company is in the early stages of IPO plans and is targeting INR 12,500-15,000 crore to fund its expansion and fundraising efforts.

D) SWOT Analysis:

(i) Strengths: Experienced management, strong partnership with Tata, and a customer-centric approach.

(ii) Weaknesses: Capital requirement for expansion, competitive market landscape, and regulatory hurdles.

(iii) Opportunities: Expansion into new product segments, leveraging government initiatives, and tapping into growing market demands.

(iv) Threats: Deep-pocketed competitors, increasing costs, and environmental legislation.

E) Strategic Focus:

(i) Innovation & Product Expansion: Commitment to introducing new products to meet market needs.

(ii) Strengthen Partnerships: Leveraging relationships with key industry players like Tata for mutual growth.

(iii) Market Expansion: Plans to explore new markets and segments, particularly focusing on import substitutes.

(iv) Customer-Centric Approach: Emphasizing understanding and meeting customer needs to drive loyalty and sales.

F) Investment Insights:

With over nine decades of experience transitioning from trading to steel manufacturing, RKB Global Ltd presents an appealing investment opportunity. The company's financial projections indicate robust growth, and its strategic focus on innovation, market expansion, and customer satisfaction positions it well for future success. The planned IPO could offer a lucrative opportunity for investors, aligning with the company's expansion and capital enhancement goals.

Conclusion:

RKB Global Ltd stands out as a dynamic player in the steel industry, with a clear strategic direction, solid financial performance, and promising growth prospects. The company's focus on innovation, strategic partnerships, and market expansion, coupled with its robust financial projections, makes it an attractive proposition for investors looking forward to participating in its growth journey.

While RKB Global Ltd's financial projections for 2023-24 and 2024-25 showcase an ambitious and optimistic view of significantly higher revenue growth and profits, it's essential to approach these projections with a degree of caution. The company's anticipated sharp increase in revenue and profit margins suggests aggressive growth targets that may be challenging to achieve in the highly competitive and unpredictable steel industry.

Fundamentals

Income Statement

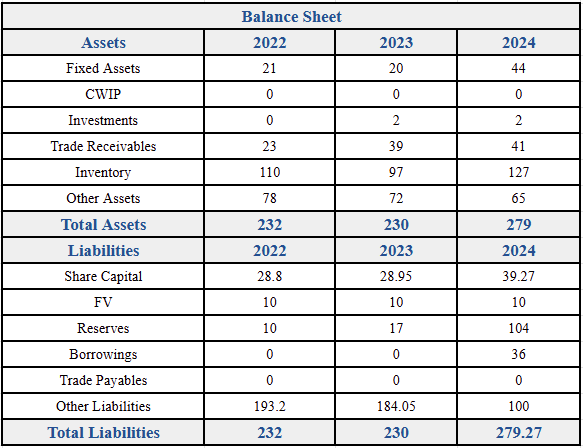

Balance Sheet

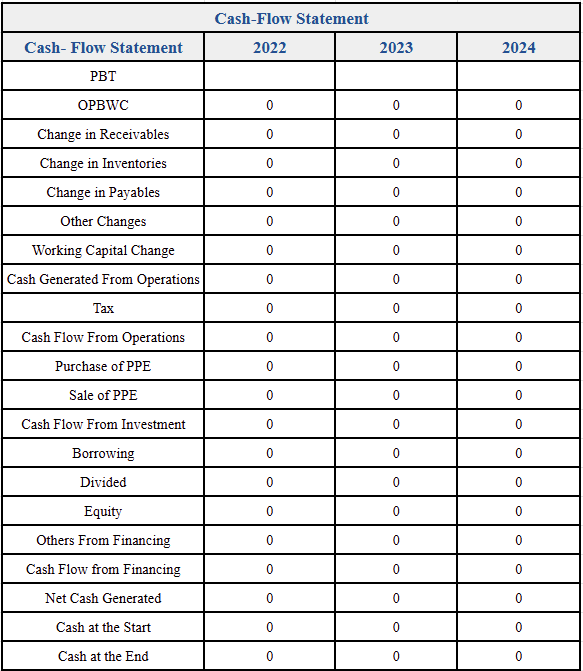

Cash Flow

Why RKB Unlisted Share is a Smart Pick for Future Growth and How SN Capital Helps

RKB Global Limited, a prominent player in the commodities and steel trading industry, has established itself as a reliable and dynamic enterprise in India's growing industrial landscape. The company operates across multiple verticals including ferrous and non-ferrous metal trading, infrastructure development, and warehousing—positioning itself as a diversified and resilient business. With India's rapid urbanization and infrastructure push, companies like RKB Global are set to benefit from sustained demand in construction and manufacturing sectors.

Investing in RKB Global’s unlisted shares offers forward-looking investors an opportunity to be part of a growing business before it becomes widely available through a public listing. The company's solid track record, strategic market positioning, and diversified operations make it a smart pick for those seeking early exposure to India’s industrial growth story. Moreover, unlisted shares often trade below their true value, giving investors a chance to enter at attractive valuations with long-term upside potential.

SN Capital plays a critical role in bridging the gap between retail investors and promising unlisted companies like RKB Global. As a trusted platform specializing in unlisted and pre-IPO shares, SN Capital offers in-depth insights, transparent pricing, and end-to-end support throughout the investment process. From due diligence and documentation to secure transactions and portfolio monitoring, SN Capital ensures that every step is smooth and investor-friendly.

For investors seeking to diversify beyond traditional assets and capitalize on the rise of industrial India, RKB Global unlisted shares present a compelling opportunity. With SN Capital's expertise and support, accessing and managing this investment becomes not only simple but strategically sound.

%20Limited%20logo.png)

logo.png)

logo.png)