logo_1724259969_66c61e81a0d61.png)

Sterlite Power Transmission Limited (SPT)

Price: ₹570

About Sterlite Power Transmission Limited Unlisted Shares

Sterlite Power is the leading global developer of power transmission infrastructure with approximately 12,500 km and over 22,719 MVA projects in India and Brazil. With its industry-leading portfolio of power ladders, EHV cables and OPGW, Sterlite Power also offers solutions to upgrade, pray and enhance your existing network. The company uses technology and innovative financing to set new benchmarks for the industry. Sterlite Power is also sponsoring Indigrid, India's first infrastructure investment (invitation) listed on the BSE and NSE.

Highlights for fiscal year 18-19

a) Overall integrated income -3571 Cr.

b) Overall District Kilometer Measuring Device - 12:500 p.m.

c) Total availability of assets (power line) -99.84%. d) The company has 22 infrastructure projects. Of the 22 projects, 12 are in India and 10 are in Brazil.

e) The company has a total of 11,300 transmission towers in its portfolio.

Highlights from FY19-20

a) Overall Integrated Revenue - 5158 Krole

b) Overall district kilometre measuring device - 13,700

c) Total availability of assets (transfer line) -99.84%

d) Completed sales of three Brazilian assets: Arcoverde, Novo Estado, and Pampa.

e) Enrollment of three projects between the strong reinforcement schema - the northeast of the West West region of XIX (WRSS-XIX) (NERSS-I), and the western region of the Western region of XXI (WRSS-XXI) and the western region of the Western region of the three projects (ISS) (ISS).

Highlights of FY21-22

a) Win 30 submission projects as part of the PPP model. 17 India and Brazil 13. These 16 are working.

b) ~13976 cckm is commissioned under power lines or construction.

c) 31.5% market share due to tariffs on interstate projects awarded in the context of competitive offers in India.

d) Availability of 99.78%v of transmission capacity.

Financial performance of unlisted Starlight stocks on FY21-22

1. Sterlite Performance recorded sales of approximately 6,000 crores of FY22 sales.

2. Starlight Performance for fiscal year 22, 21, recorded a PAT of 440 crores in fiscal year 22.

3. Wins 30 submission projects as part of the PPP model. 17 India and Brazil 13. These 16 are working.

4. ~13976 CKM is commissioned under power lines or construction.

5. 31.5% market share according to the customs duties of the interpretation project awarded as part of the competition in India.

6. 99.78% availability of transmission assets achieved across the commissioned assets in Q4FY22

Sterlite Power Private Stock Investors Updated with 9MFY23 Results and Future Outlook

a) Business Rates for Q3 and 9M-FY23

1. Get your Kishtwar Transmission Limited (Kishhtwar) Project SPV from PowerFinance Corporation (PFC) and build a 400/132-kV conversion with Kishhtwar over the next 30 months, and a 400-kV Lilo

2. Q3's 329 km 765kV Lacadia Badodara Transmission Project Complete - LVTPL (Founder - Conversion Corridor). The project was then commissioned in January 2023.

3. The definitive document implemented to sell the commissioned Hagone Transmission Project to Indigrid for Rs. 1,497 crores as part of the asset flip strategy

4. In the second quarter, two new projectswere won in Brazil, 1.21.2 billion (2Applox. 1,900 crores).

5. Complete commissioning of Solaris I&II Project & Borhorma I Project in Brazil

b) Order Business Win

The total product, MSI, and convergence for the first three quarters of this fiscal year is Rs.

c) Increase in capital

1. We have secured 305 crore of debt funding from Assamemo Infra Finance Limited. -Non-banking finance company (NBFC) funded by the National Investment and Infrastructure Fund (NIIF) for the December 2022 Kishtwar project

2. I received fresh operating capital boundaries from Rs

3. Efforts are being made to include private capital in India's "infrastructure" trade unification

4. The second successful version of Green Culprit bonds, equivalent to Sterlite Brazil Partaãμs S.A., a subsidiary of Brazil's Starlight Power.

d) Financial highlights of 9m-FY23

1. Revenue from Business: 37% higher than the corresponding 9 months of 22 years (revenue increases in sales over the past four quarters in a row)

2. EBIDTA: 8% higher than the corresponding 9-month fiscal year EBITDA 2222

3. Balance size: 60% higher than the corresponding 9-month balance sheet size of GJ22

e) Future Outlook

1. In December 2022, the Indian government presented Rs. As USD 2.44 trillion ($29.6 billion) will almost triple by 2030, it plans to build new power transmission lines to combine renewable energy production. This will have a multi-year impact on the order book pipeline for all business lines of the company.

2. NCC, approximately 400 million pipelines were approved in the final four sessions of the NCC National Committee (NCT). From India, it could lead to a heavy bidding pipeline for infrastructure business units in the next two to three quarters.

3. According to Starlight Power Pratic Agarwal, Maryland, "The power transmission sector in India is upwards, driven by the urgent need for a robust transmission infrastructure to integrate ~500 GW of renewable power by 2030. As announced by the Ministry of Electricity, the government. In India, the "Interstate Transmission System" (ISS) segment alone requires 2.44 trillion investments. This means great opportunities for the industry in the coming years. "

Deteriorating due to financial repetition of the infrastructure business and Starlight Power

Sterlite Power Transmission Limited's Infra Business has been transferred to a newly formed company, Sterlite Grid 5. As a result, only the global product business within Sterlite's performance remains. This year, Sterlite Power presented its financial data for fiscal year 2023 only in its continuous business activities. In other words, previous financial data is not directly comparable.

CRISIL Upgrades Sterlite Power Ratings

-

Rating Upgrade: On April 15, 2025, CRISIL upgraded Sterlite Power’s long-term rating to AA-/Stable and short-term rating to A1+, removing the company from rating watch.

-

Upgrade Rationale: The upgrade reflects the successful demerger of Sterlite’s EPC business, allowing the company to sharpen its focus on the high-margin solutions segment. This move is further supported by an equity infusion of ₹725 crore and improved efficiency in working capital management.

-

Financial Performance: In FY25, Sterlite Power posted revenues of ₹4,763 crore, sustained a robust Return on Capital Employed (ROCE) above 20%, and reported a strong order book worth ₹26,675 crore, reinforcing its positive growth outlook.

Fundamentals

Income Statement

Balance Sheet

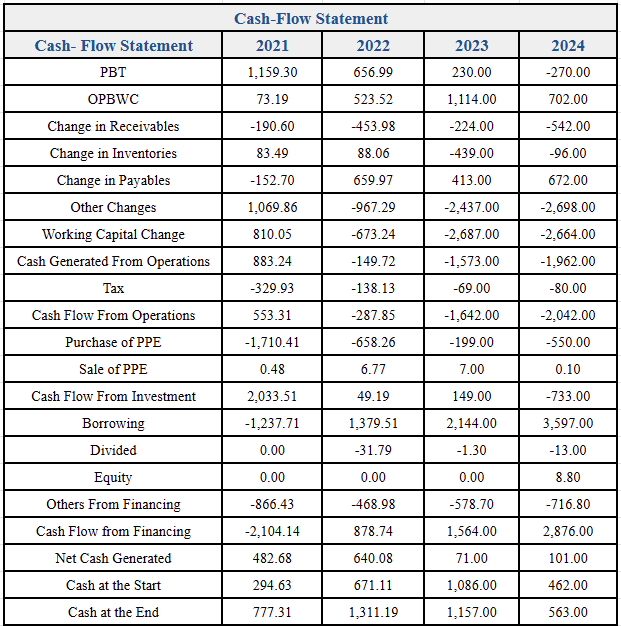

Cash Flow

Why Sterlite Power Unlisted Share is a Smart Pick for Future Growth and How SN Capital Helps

Sterlite Power Transmission Limited is one of India’s leading private power transmission infrastructure companies, known for its innovation, scale, and execution capabilities. With a strong presence in both domestic and international markets, Sterlite Power is at the forefront of solving complex challenges in energy delivery. As India accelerates its renewable energy goals and grid expansion, the demand for efficient, large-scale transmission infrastructure is set to grow—placing Sterlite Power in a prime position for future success.

Investing in Sterlite Power’s unlisted shares allows forward-thinking investors to participate in the growth of India’s critical power sector before the company becomes publicly listed. Sterlite Power has consistently demonstrated strong project execution, strategic partnerships, and robust financial performance. Its forward-looking initiatives in green energy corridors and smart grid solutions make it a standout in the infrastructure space. By investing early, investors can gain exposure to a sector that is both essential and poised for long-term expansion.

This is where SN Capital becomes a valuable partner. Specializing in unlisted and pre-IPO investments, SN Capital offers investors access to high-growth companies like Sterlite Power that are not yet available on stock exchanges. From expert research and company insights to seamless transaction support and transparent pricing, SN Capital ensures that investing in the private market is secure, informed, and convenient.

Whether you're a seasoned investor or looking to diversify into infrastructure and energy, Sterlite Power unlisted shares offer compelling potential. With the guidance and support of SN Capital, you can confidently explore this opportunity and be part of India’s power revolution—before the rest of the market catches on.

%20Limited%20logo.png)

logo.png)

logo.png)