Studds Accessories Limited

Price: ₹675

About Studds Accessories Limited Unlisted Shares

a) Studds Accessories, which started its journey in 1972 by manufacturing the first helmet in a garage, is today manufacturing 7 million helmets and motorcycle luggage every year. Studds Accessories Limited has today grown to become the largest two-wheeler helmet manufacturer in the world. UNIQUE- Their laboratory is the only one in the industry (in India) to be certified by the European Safety Agency, and Safety - They use one of the best technologies in the world to produce certified products. In FY19-20, they

have manufactured 66 Lakhs helmets, up from 58 Lakhs last year.

b) Headquartered in Faridabad, the Company has four state-of-the-art facilities manufacturing an extensive array of over 50 products. Backed by a rich legacy, a strong product portfolio, and a robust dealer network, the Company has more than 26% market share in India and offers products to more than 40 countries across the globe.

c) The company has 4 business verticals.

1. Helmets

2. Motorcycle Accessories

3. Face Shields and Face Masks.

4. Bicycle Helmets.

d) As of 31st March 2020, Studds Accessories has a network of 385 dealers spread across the globe and 7 EBOs in India. The company has 2053 employees.

Presence of the Company

The company has a presence in almost 40 countries around the world.

Competitiveness

a) Innovation- 16 New product launches in the last 3 years.

b) Excellence- 21 No. of quality/safety tests done in-house (per helmet as per ECE 22.05 standard).

c) Adaptability- 7 Different sizes are available in the helmet.

d) Presence- over 385 Active dealer networks across India as of 31st March 2020 across more than 40 countries.

Look and Feel of the Products of the Company

Full-face helmet

Flip-up Full-face Helmets

Sporting helmets and industrial Helmets

Revenue Model of Studds Accessories Limited

(a) The company sells helmets under the brand name Studds in the range of Rs 825 to Rs 2,165 and has a market share of 25% in FY18.

(b) The company sells helmets under the brand name SMK in the range of Rs 2,300 to Rs 9,800 and has a market share of 27.79% in FY18.

(c) Besides selling helmets, the company also sells motorcycle accessories such as jackets, gloves, and glasses.

(d) 90% of the revenue comes from the helmet segment and 10% from motorcycle accessories.

(e) 92.3% of the business comes from the domestic market, and the remaining 7.97% comes from exports. Final Communication with Management – May 16, 2020

Analysis of Financial Year 2019/20:

Studs Accessories Limited Business Highlights

1. Despite market challenges, Studs performed well, with sales increasing by 10.85%. In addition to the increase in revenue, operating EBITDA increased by 41.16% year-on-year and PAT increased by 81.05%.

2. During the year, Studs has made significant investments in building a world-class research and development facility and achieving backward integration through the manufacturing of EPSL in its factories, to improve product quality and maintain strict safety standards.

3. During the year, the company intensified efforts to improve its relationship with dealers and distributors, thereby increasing its market share significantly. As of March 31, 2020, the network is spread across 385 dealers across the world and 7 EBOs in India.

4. During the year, the company launched new products such as B. Titanium Fibre, Titanium Carbon, and Suburban. They plan to further strengthen this segment by introducing riding apparel, jackets, armor, elbow pads, knee pads, and footwear. 5. The company has sold 66.5 million units (domestic and global) this year, with a global domestic market share of 25.66% for two-wheeler helmets.

Studds Accessories Limited Financial Results 2020-21:

What are the statistics for Studds Accessories Unlisted Stock for FY2021?

1. The total number of helmets manufactured by Studs is approximately 640,000.

2. They export to more than 45 countries.

3. They are the largest helmet manufacturer in the world.

4. Studds Accessories has four manufacturing facilities in Haryana.

5. Human capital is 2722.

Impact of COVID-19?

Despite a slow start to the first quarter of fiscal 2021 and a near complete halt in its manufacturing units due to the nationwide lockdown imposed by the Indian government to contain the spread of coronavirus, Studs managed to deliver all the orders it received during the year in the second half of the year. Availability of raw materials remained a challenge for the company throughout the year due to the impact of COVID-19 on its finances. However, Studs worked closely with its suppliers to ensure the timely availability of all raw materials to complete orders on time.

Are there any opportunities for Studs Accessories Limited?

Due to growing safety concerns, governments around the world are making helmet use mandatory for motorcyclists. This has given new impetus to the largely fragmented helmet market and continues to create new opportunities for the domestic and international markets for Studs Accessories.

Industry Overview of Motorcycles and Helmets Market

1. The Indian motorcycle market contracted significantly in 2020 due to the COVID-19 pandemic, which led to multiple lockdowns at state and national levels across the country.

2. In March 2021, scooters, motorcycles, and mopeds recorded sales growth of 74.0%, 74.1%, and 36.2%, respectively, compared to the same period last year. This was primarily due to very low activity in the same period last year.

3. India is the largest market for two-wheelers (scooters, mopeds, motorcycles, etc.) and is one of the most competitive two-wheeler helmet manufacturers in the world, with an annual production of 35 million units.

4. In India, the two-wheeler helmet market is expected to grow by around 25% by 2022. As consumers become more safety-conscious and two-wheeler helmets are equipped with more advanced safety features, the two-wheeler helmet market is expected to grow significantly.

5. As per the Motor Vehicles Act, wearing helmets is mandatory for two-wheeler riders. Further, the government has passed a policy banning the manufacture, sale, and use of helmets without ISI certification. The policy came into effect on June 1, 2021. This marks an important step towards improving safety for two-wheeler riders. The government has taken many steps to ensure driver safety, which is a positive development. The helmet industry will benefit from all these factors.

Key takeaways for FY 2018/19

1. The company recorded a revenue growth of 16% YoY in FY 2018-19.

2. The company recorded a PAT growth of 23% YoY in FY 2018-19.

3. The company is almost debt-free. D/E is 0.247

4. The company has achieved good profitability metrics (ROE and ROCE) for the last three years.

Most Important Takeaways from FY 2019/20

1. Studs recorded sales of Rs 431 crore in FY 2019-20, up 10.8% YoY.

2. Studs achieved EBITDA of Rs. 130 crore in the financial year 2019-20, up 41% YoY.

3. Studs achieved PAT of Rs. 74 crore in the financial year 2019-20, up 84% YoY.

4. Earnings per share for 2019-20 are $37.

5. Total debt is Rs 27 crore and net worth is Rs 21.6 crore, i.e., D/E is 0.12. 6. The RONW for 2019-20 is 34%.

Financial Analysis for FY2020/21

1. In FY2020/21, sales of studded accessories grew by 15% despite the economic challenges caused by COVID-19. The company recorded sales of Rs. 484 million in FY2020- 21 compared to Rs. 420 million in the previous year.

2. EBITDA for FY2021 is Rs. 115 million compared to Rs. 130 million in FY20. This equates to a margin of 23.7% in FY21 compared to 24.5% in the previous fiscal year.

3. PAT remains unchanged at 73 million, similar to last year. PAT remains the same due to higher depreciation expenses from the construction of new production facilities and higher financing costs.

Balance Sheet Analysis

1. In FY2020-21, their focus on capital expenditures led to an increase in fixed assets from Rs 154 crore to Rs 260 crore.

2. As of FY21, they have around 270 crores of liabilities and 290 crores of net worth, i.e., D/E is less than 1.

3. Liquidity ratio = 1.43x (very comfortable)

4. Return on equity is 25%, which is quite good.

5. In FY2020-21, Studs generated a free cash flow of Rs 3,700 crore. Last year it was zero.

Studded Accessories Unlisted Equity Financial Analysis, FY2021- 22

1. The company sold 5.9 million helmets during the current fiscal.

2. The market share of helmets in India is 25.5%.

3. 80% of sales are domestic and 20% are exports.

4. The first quarter of last year was heavily affected by COVID-19. However, after the pandemic, the motorcycle industry has started growing again.

5. Studds' revenues fell from Rs 479 crore in FY21 to Rs 462 crore in FY22. The impact was felt during the second wave of COVID-19.

6. Gross margins fell from 52% in FY21 to 43% in FY22. This was due to rising raw material prices.

7. Due to high material and other expenses, PAT was reduced from 73 million to 28 million.

8. The stock of helmets increased from 28 million to 43 million.

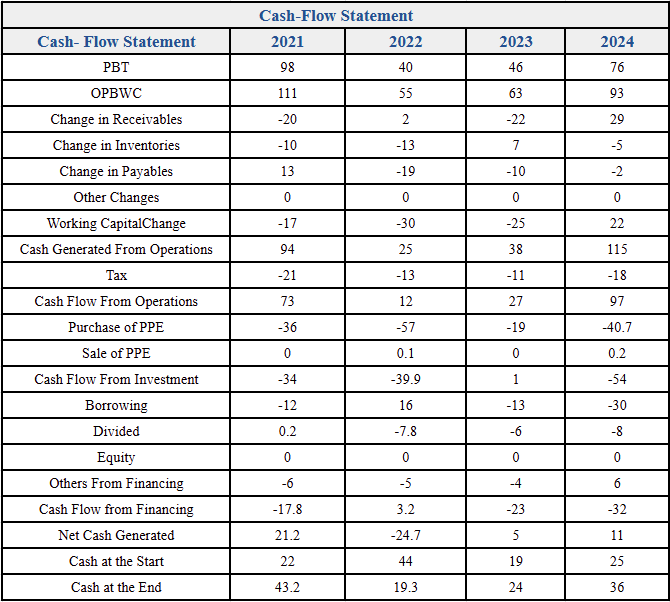

9. In FY21- 22, the Studds Unlisted Share has done a Capex of 56 Crores. Now, as they have generated only 11 Crores cash from Operations, they need 44 Crores from other sources. For that, they have sold one FD of 11 Crores, 25 Crores is used from cash available in the books, and the remaining 8 Crores from other sources. So, overall, we can say the results are very bad for Studds Accessories.

Valuation of Studds Accessories

Total Outstanding Shares = 1.96 Crores

Studds Unlisted Market Price = 900 Mcap = ~1760 Crores

The current valuation looks stretched based on FY23 results.

Fundamentals

Income Statement

Balance Sheet

Cash Flow

%20Limited%20logo.png)

logo.png)

logo.png)